Just how can Personal loans Compare with Conventional Loans?

Every single business need working capital to fund go out-to-time costs. Either, your company ple, need a loan to greatly help funds seasonal expenses, or a crisis expenses generated your finances bring a hit. If you’d like working-capital, a personal bank loan to have providers are often used to money your functional expenditures.

Disaster Expenses

An urgent situation normally derail your company preparations easily. If you’re scrambling to generate the cash to pay for a crisis, a consumer loan to possess providers can help. Instead of emptying your finances, pay money for their unanticipated expenditures over the years with an inexpensive personal mortgage.

Index & Provides

Collection and you may provides are essential for productive businesses and you may came across consumers and you will readers. If or not an unexpected emergency keeps leftover your bank account a tiny short otherwise a regular escalation in transformation demands more inventory and you can provides than normal, a consumer loan for organization is also safety this type of costs.

Almost no time Running a business Needed Zero Minimum Team Money Necessary Can also be Be taken For various Aim Usually has Low Borrowing Number You might be Truly Liable From inside the Default

In practice, private and you can loans have become similar. Really finance is fees finance, which means that you’re going to get the bucks once the just one contribution and pay it off during the fixed, occasional installment payments. However, you will find some differences that might apply to which type of loan is most beneficial to suit your needs.

Which is Riskier, A consumer loan Or A corporate Loan?

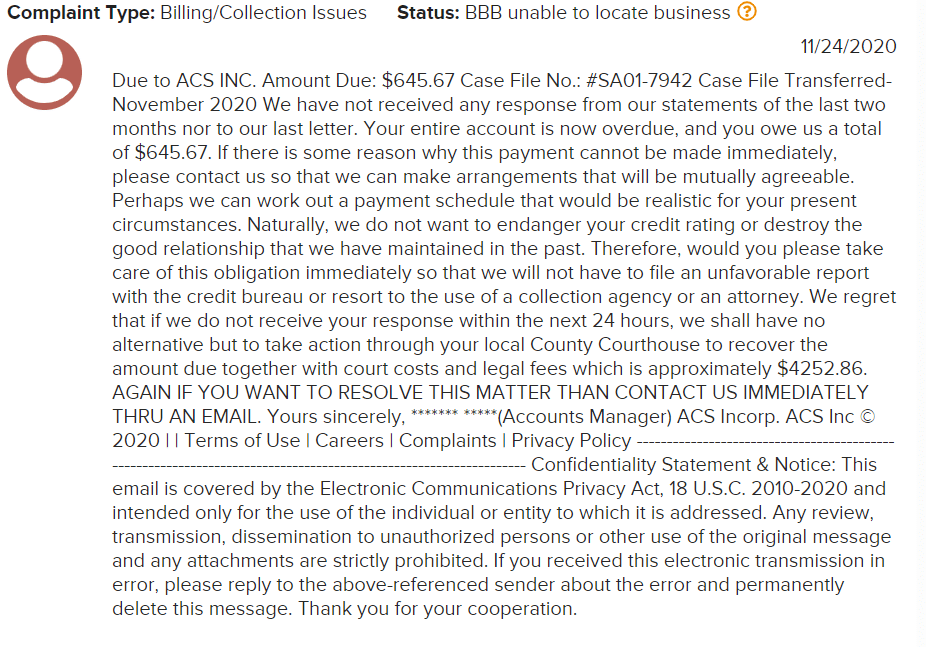

Since you you are going to expect, private and you will business lenders require something different if it involves risk study. When you are a corporate financial is going to look at your company earnings, an individual bank will simply be interested in your private earnings. They are going to primarily view recommendations such as your credit rating, credit score, earnings, and personal expense. In loan application techniques, you will need to bring data files you to verify this article.

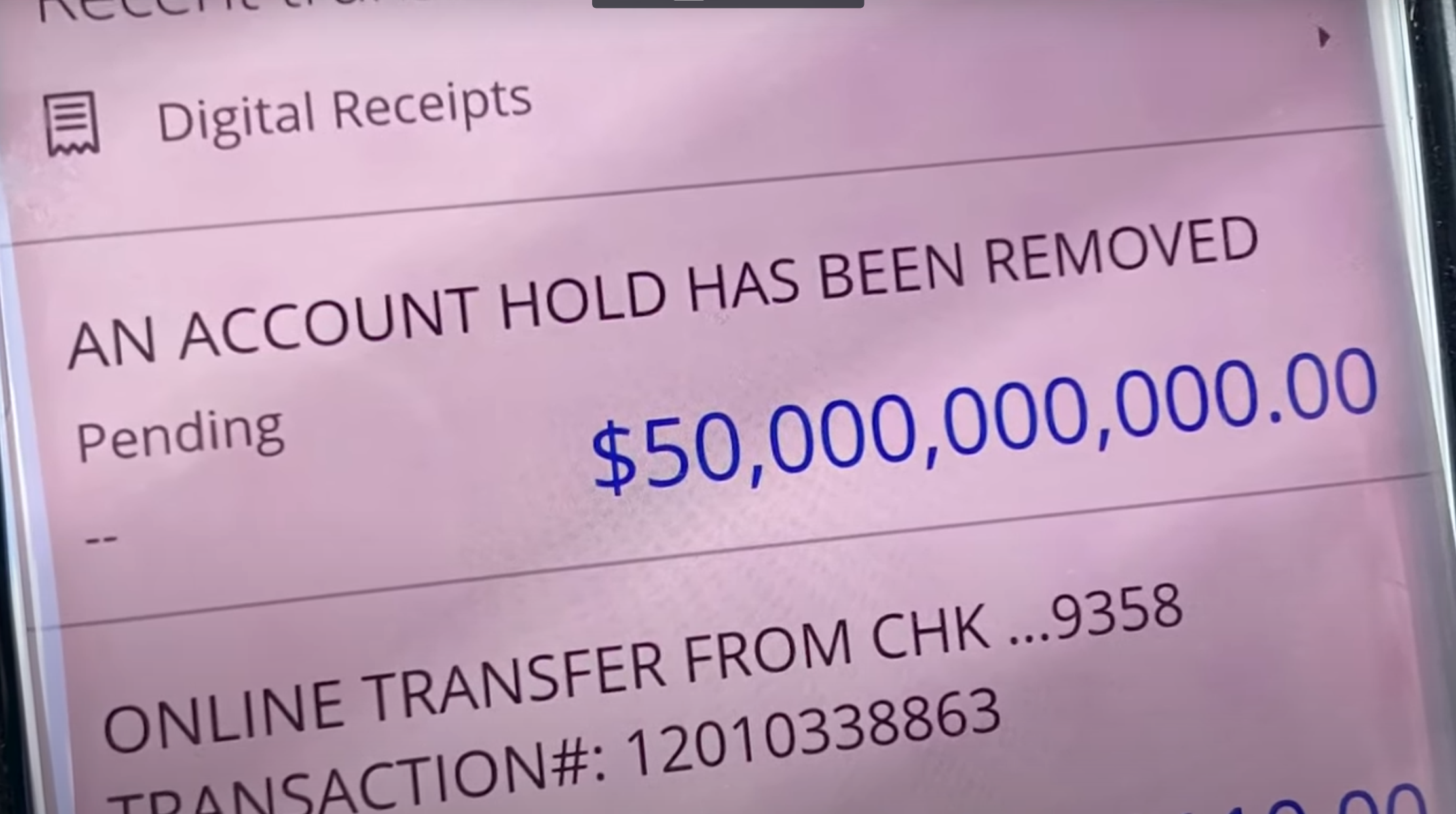

Borrowing from the bank Number Opposed

When you are organizations is also use huge amount of money for the loans (if they have the new methods to repay it), unsecured loans are typically to own much a small amount. Extremely individual loan providers would not provide more all in all, $forty,100 or $50,100. Needless to say, the quantity you are provided is based on your ability to repay the mortgage. To determine how much you can safely acquire, the underwriter will at the pointers like your earnings and you can debts to choose just how much extra currency you must make loan money.

Equity Needed for Signature loans

The majority of signature loans try unsecured. Getting comparison’s benefit, loans may require one to arranged security or indication an individual make sure. Unsecured loans are considered higher risk than just money protected by the certain security, and therefore they typically carry higher interest rates and you may fees so you’re able to account fully for the extra risk. That said, you are able to select secured finance if you have anything you happen to be happy and able to explore due to the fact equity.

When you should Explore A personal bank loan For your business & When to Eliminate it

You need to use an unsecured loan to fund your business, nevertheless the question for you is: should you? You can find items in which signature loans having organization have fun with result in the really sense, while some where another monetary product is recommended.

Have fun with A personal loan Having Company If…

You do not Yet , Individual A corporate: If you’re in the beginning grade of the business and you can have not but really launched the doorways otherwise come making profits, youre unrealistic so that you can see a business loan. Instead, clickcashadvance.com 2016 guaranteed approval mortgage loan credit score 550 with a $10000 down payment a personal bank loan helps you financing startup costs and also your company up and running. You never Qualify for Organization Financing: If you find yourself currently discover getting providers but never be eligible for money because of the age your online business otherwise reasonable cash, you need to use a consumer loan to save something performing whenever you are you beat early-organization barriers. You’re in A risky Globe (Such Foodservice): Businesses in the high-risk otherwise undesirable markets usually have troubles getting an effective organization loan given that lenders are afraid they don’t manage to get thier money straight back. Rather, you may find it better to score that loan which is associated with a creditworthiness, not the creditworthiness of business. Personal loans Are less costly: If you have good personal borrowing from the bank and you may a minimal personal debt-to-money proportion, you can qualify for a consumer loan with low prices and you will fees. This is a far greater solution than a business financing if the your business creditworthiness isn’t really of the same quality since your personal creditworthiness.