Opportunities for beginners: six How to get Become

While you are each other mutual finance and you can ETFs is form of finance, they efforts a small differently. Mutual finance buy and sell a variety of property and you will are frequently positively treated, definition an investment top-notch chooses what they purchase. Shared money tend to want to manage much better than a standard list.

Whether you’ve got $1,100 arranged or can be manage merely an extra $25 per week, you can buy started. Bear in mind that there’s a lot that you can and you will is always to understand investing in carries to get to economic achievements. Although not, now, keep reading to the actions to start the method. Continuously spending makes it possible to make use of pure industry action.

One show price is basically the ETF’s funding minimum, and you will with regards to the financing, it will range from less than $a hundred to $300 or even more. And if you’re also interested in learning simple tips to dedicate, however you you desire a tiny assist getting out of bed to help you rate, robo-advisers might help truth be told there, as well. It’s useful to find out how this service membership constructs a profile and just what opportunities are utilized. Specific characteristics also offer educational posts and you may products, and a few also enables you to customize their portfolio so you can a degree if you want to test a while from the future. When you have an excellent 401(k) or other old age bundle at the office, it’s very likely the initial place to consider putting your money — particularly when your company suits a portion of your benefits.

Securities are debt burden from entities, for example governments, municipalities, and businesses. To buy a thread ensures that you hold a share from an entity’s personal debt and they are eligible to found unexpected focus money and you can the new get back of your bond’s par value if this develops. A purchaser away from a business’s stock will get an excellent fractional proprietor from one organization. Owners of an excellent organization’s stock are known as the shareholders and you will is participate in the development and you can success because of enjoy regarding the stock rates and you will typical dividends given out of your organization’s earnings. What’s completely wrong which have simply playing it secure with pension currency and you can keeping it inside the bucks? Once you do, you’ll end up being well-positioned to take advantage of the newest ample possible you to definitely stocks have to prize your economically over the years.

In contrast, reduced risk form you can also make a profit a lot more reduced, but your financing is safer. ETFs along with include numerous dotbig forex broker reviews otherwise a huge number of personal ties. Instead of trying to defeat a particular list, but not, ETFs basically you will need to copy the fresh performance from a specific standard index. It couch potato method to paying mode your profits will in all probability never surpass average benchmark results. Merchandise try farming things, opportunity services precious metals, as well as gold and silver. These assets are often the fresh garbage used by community, in addition to their prices rely on business request.

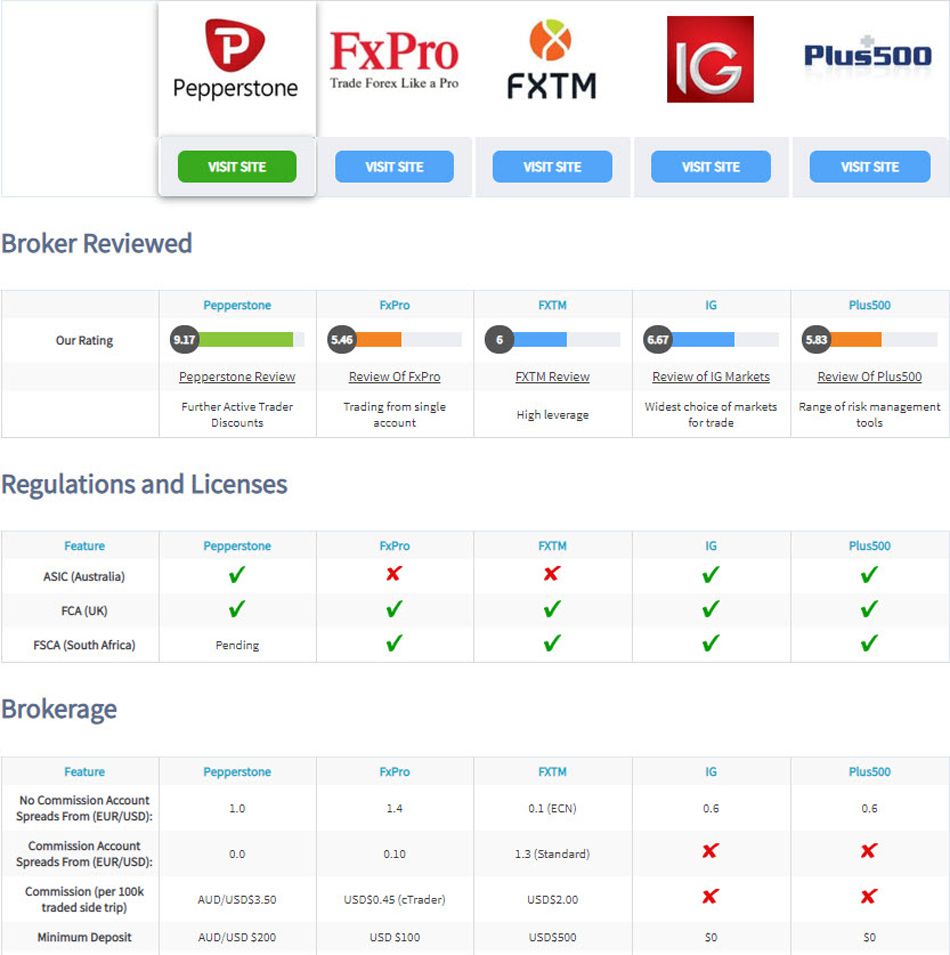

Traders is on their own purchase without any assistance of a financial investment elite group otherwise enlist the help of a licensed and you can entered financing mentor. Technology has provided buyers a choice of acquiring automated funding options as a result of roboadvisors. Within the 2001, the newest failure of Enron got heart stage, having its complete screen of ripoff you to bankrupted the firm and you can their bookkeeping company, Arthur Andersen, and a lot of the buyers. This type of money comprise entirely of one’s brings within a particular list. Its smart to buy as much as, and not to determine lowest deposits. Other people could possibly get keep costs down, such trade fees and you may membership management charges when you have an equilibrium more than a certain threshold.

You should buy ETFs or common money one to song a certain inventory list or seek to create a market-beating collection. Or, you might discover a free account that have an excellent robo-coach to automate the method and also have contact with brings instead wanting a huge amount of knowledge to get going. Including, for those who have a comparatively high risk endurance, and the some time and want to search personal holds (also to can do it right), that would be the best way to wade.

The contributions is tax deductible and your balance increases taxation deferred. This is a terrific way to maximize your paying cash which have absolutely nothing work. It can also instill in the traders the new abuse of regular using.

Financing such as ETFs and you can common fund enable you to spend money on various or a large number of property at a time after you pick their offers. This easy diversification tends to make common financing and you will ETFs essentially safer than just personal investment. Spending is the process of to purchase assets you to definitely boost in value through the years and gives output in the way of money money or money growth. In the a bigger sense, using is in the hanging out otherwise currency to change their life or the lifetime from anyone else. But in the industry of money, investing ‚s the purchase of bonds, home and other bits of well worth regarding the quest for financing growth or money. Spending ‚s the work from publishing information on the one thing to generate money or gain winnings.

Investing as well as is different from speculation in this on the latter, the money is not acted upon for each-se, it is gambling to the brief-identity rate movement. As the desire begins to accumulate on your invested interest, it’s put in their golf ball of cash. You continue to secure interest, what you owe grows inside worth and sees rate — and on as well as on it goes.

Best Robo-Advisers: dotbig forex broker reviews

To buy shares from stock provides you with partial control away from a family and allows you to be involved in their development (and also the losings). Certain carries as well as pay dividends, which are small normal costs out of enterprises’ earnings. A market directory try various opportunities you to depict a great part of the industry. For example, the new S&P five hundred are a market list you to keeps the new brings from about five-hundred of one’s prominent businesses in the You.S. An enthusiastic S&P five hundred list finance create try to echo the newest efficiency from the newest S&P 500, purchasing the stocks for the reason that list. Of several savers favor having people invest their cash in their eyes.

The fresh spectral range of assets where one can possibly invest and you can secure an income are an extremely greater one to. If the boss offers an excellent 401(k) or any other senior years package and you are clearly contributing, you’re sure currently paying. However, if you don’t have a retirement bundle at work or you should complement you to plan, you could open a single membership such IRA. Spending doesn’t require on a regular basis trading any of the possessions above. While some advanced, energetic traders participate in a variety of speculative investing titled go out change, of many buyers buy and keep property for the long term and you can can be enjoy similar or even high benefits doing so. Everbody knows inventory locations is places where offers away from control within the a family, carries, are offered.

Energetic using does not always mean selling and buying holds apparently, this does not mean go out change, also it does not always mean to find stocks you think are going to increase across the next couple weeks otherwise weeks. The degree of consideration, otherwise money, necessary to dedicate would depend largely on the kind of financing and you will the fresh investor’s financial position, requires, and you will requirements. Yet not, of a lot automobile features decreased the minimal funding requirements, making it possible for more people to become listed on. That have spending you devote your bank account to work inside plans or items which might be anticipated to make a positive get back over time – he’s got positive expected production. Gambling would be to set bets for the negative effects of occurrences or video game.

Which’s great, as the investing is going to be a powerful way to construct your riches. We’re regularly seeing groups playing with lots of conditions about their tech, but when you indeed view its team’s tool, there’s no standard tech invention. Even after the manner in which you love to invest otherwise everything you love to spend money on, lookup your address, along with your investment manager or platform. Maybe one of the best nuggets away from knowledge try out of experienced and you will completed individual Warren Meal, „Never ever buy a business you can not understand.” Investing is different from saving for the reason that the cash utilized is put to be effective, which means there is certainly particular implicit chance your relevant enterprise(s) can get fail, resulting in a loss in currency.

- The brand new spectrum of possessions where one can purchase and you may secure money are a highly broad you to definitely.

- There are various from senior years accounts; an element of the distinctions matter the new commission of cash taxes, if or not you can open the fresh account separately otherwise because of an employer and you will contribution limitations.

- Otherwise, you could open an account with a good robo-advisor in order to automate the method and have exposure to holds as opposed to wanting a ton of degree to begin with.

- At the same time, if the output slip, thread financing is always to surpass.

The best way to purchase relies on your own preferences along together with your current and you may upcoming economic issues.

As well as winnings out of investment gains and enjoy, investing work after you buy and you may hold property you to generate income. Instead of realizing money progress by attempting to sell an asset, the intention of earnings spending is through buying assets you to definitely generate cash flow over time and you may keep her or him instead attempting to sell. A goal-go out common finance tend to retains a mixture of stocks and you may bonds. If you are planning in order to retire within three decades, you could potentially prefer a target-go out finance that have 2050 or 2055 on the label.

Define Your own Tolerance to own Risk

The brand new dollars risks various other correction experience today because the rising prices will get… Gordon Scott has been an energetic trader and you can technology specialist or 20+ many years. It’s such an excellent runaway snowball of cash growing larger and you will larger since it rolls together.

You can in addition to spend money on one thing simple, such home otherwise a house, otherwise sensitive and painful items, such as fine art and you will collectibles. What’s nice regarding the mutual finance would be the fact in one single exchange, traders can get a good neatly manufactured type of opportunities. It’s instantaneous, simple diversity (exposure to several different organizations) one to enables you to prevent to purchase carries 1 by 1. You could potentially unlock an enthusiastic IRA and you will an agent membership during the an on line brokerage, up coming import funds from a bank otherwise savings account. Some people love to import a lump sum, while others like to establish typical efforts.

100 percent free Equipment

Here are most other spending terms to get you outside the principles. But not, efficiency throughout these account you’ll remain below the newest enough time-label get back you would earn investing — even in an atmosphere with large interest levels such as we’re already experience. So if you’re alarmed your offers may well not maintain with rising prices, Zigmont says to recall the work your assigned to those funds, which is getting here when you need it and never secure a premier return.

Investing words, simplistic

Over the years, it will slow move several of your bank account on the securities, following general rule you want for taking some time shorter exposure as you means senior years. You might open a number of non-later years profile at the an online agent. Once you learn your goals, you can diving for the details for you to invest (out of picking the type of account on the best place to help you unlock a merchant account so you can opting for money auto).

If your employer offers a pension bundle, for example a great 401(k), spend some small amounts from your pay unless you increases your financing. Should your workplace participates inside complimentary, you can also understand that your investment provides doubled. Even the most frequent is carries, securities, a home, and you will ETFs/mutual money. Other kinds of investment to adopt is home, Dvds, annuities, cryptocurrencies, commodities, collectibles, and gold and silver coins. There are even common finance one dedicate entirely inside the businesses that conform to specific moral or environment principles (aka socially in charge finance).

The question out of „simple tips to invest” relates to whether you’re a do-It-On your own (DIY) form of trader otherwise would prefer to get currency managed because of the a specialist. Of a lot traders whom like to create their funds by themselves has profile available for sale or on the internet brokerages because of their lower income and the convenience away from carrying out investments to their networks. Because the index finance fundamentally charge all the way down fees, called costs ratios, than traditional common financing. And that lower cost is a huge-day improve to your total efficiency. However, many people say they feel it’s too risky or it wear’t know how to invest currency.

Craigs list in the Maps: step 3 Anything Smart Investors Should be aware of Once Q3

Eu investment on the strong technology remains good, even after wide investment top drop-offs. Dealroom’s latest Western european Strong Tech Report implies a good 60% rise in financing membership in the last a couple of years, compared to the 2020. Which boom is even shown inside patents pending and Roentgen&D shelling out for moonshot technology. Christine Benz, a movie director away from individual fund and you can senior years planning for Morningstar, told you traders is actually gravitating to the highest production today to get worth — some other core idea of the Bogleheads.

Exchange-traded financing help a trader purchase loads of holds and securities at a time. Basically, passive paying involves putting your money to be effective within the funding automobile in which anybody else has been doing the tough work. For example, you could hire a financial otherwise investment advisor — otherwise explore a great robo-coach to build and apply a financial investment approach on your behalf.

Investing money in the market is amongst the main a method to make wide range and you will conserve for very long-identity needs for example retirement. However, learning an educated solution to purchase those funds can also be end up being daunting. That does not should be the way it is, whether or not — there are some easy, beginner-amicable a method to purchase.

Money business instantly

Our very own partners never pay us to make sure beneficial reviews of the products or services. We think people can build monetary choices that have confidence. The newest iShares 20+ Seasons Treasury Thread ETF (TLT), features viewed $19.8 billion inside the property ton inside year, based on BlackRock.

Mostly because of that, more actively addressed common money in reality underperform their benchmark index. Extremely brokers costs consumers a commission per change. On account of fee will set you back, investors fundamentally notice it wise so you can limit the final number from positions which they create to quit using more income on the costs. Certain other types of opportunities, such as change-replaced fund, hold costs in order to security the costs from financing administration. Strengthening an excellent diversified profile of individual stocks and you will bonds takes time and you will systems, so most buyers make the most of finance paying.

Even though you happen to be starting with only $100, there are some methods for you to start off. The brand new 20th century spotted the newest ground becoming broken-in investment concept, for the development of the fresh basics in the advantage prices, portfolio concept, and you can risk management. Regarding the second half of one’s twentieth 100 years, new money vehicle were introduced, and hedge money, private collateral, capital raising, REITs, and you can ETFs. Particular brokers do not have (or very low) minimal deposit restrictions.

Deciding exactly how much exposure to take on whenever using is known as evaluating your own exposure threshold. For those who’lso are at ease with much more brief-label ups and downs on your funding worth to your opportunity of higher enough time-label output, you really have higher risk tolerance. Concurrently, you can feel better having a slowly, a lot more moderate price of get back, with a lot fewer ups and downs. Futures and you may choices using seem to relates to trade that have currency you obtain, amplifying your prospect of losses.

Although that used as a costly proposition, today you could find it’s contrary to popular belief sensible to employ specialized help because of the introduction of automated profile administration functions, a great.k.a good. robo-advisors. Paying after you’lso are young is one of the how do i see strong efficiency in your money. That’s because of substance money, which means that your funding efficiency initiate earning their get back. Compounding allows your account balance to help you snowball throughout the years. However when you wrangled budgeting for those month-to-month expenses (and put aside at least a little cash in an emergency fund), it is time to begin using.